Trust is the only currency that truly matters when you are asking someone to hand over their life savings. In the financial sector, you are not selling a physical product that can be returned if it does not fit; you are selling a promise of security, growth, and future stability. While robo-advisors and algorithmic trading have commoditized asset allocation, the human need for guidance remains the ultimate differentiator. This is where a strategic content marketing plan for financial services becomes the engine of your growth. It bridges the gap between cold data and human decision-making.

Table of Contents

At a Glance: What is a Financial Services Content Plan?

A content marketing plan for financial services is a comprehensive, compliance-focused strategy used by banks, RIAs, and insurers to attract and convert clients through educational media. Unlike general marketing, it must strictly adhere to the SEC Marketing Rule and FINRA Rule 2210 to avoid misleading claims. An effective plan combines high-quality SEO for financial services firms, interactive tools, and automated workflows to nurture leads from initial “financial literacy” searches into high-net-worth appointments and funded accounts.

Navigating SEC and FINRA Compliance in Financial Services Marketing

Marketing in finance is a legal activity. Before you draft a single blog post or record a video, your “Content Supply Chain” must be secured. The most creative campaign in the world is worthless if it results in a regulatory fine or reputational damage. Understanding the boundaries of the SEC Marketing Rule and FINRA compliance is the first step in building a sustainable financial services marketing strategy.

Leveraging the New SEC Marketing Rule for RIA Testimonials

For decades, investment advisers were shackled by archaic rules that made modern marketing nearly impossible. The modernization of the SEC Marketing Rule (Rule 206(4)-1) has shifted the landscape entirely. This rule now permits the use of testimonials and endorsements for RIAs, creating a massive opportunity for content marketing for financial advisors.

However, this freedom comes with strict conditions that must be woven into your content strategy. You cannot simply copy and paste a glowing review from your Google Business Profile to your website. You must include clear, prominent disclosures stating whether the person giving the testimonial is a current client. You must also disclose if they were compensated in cash or non-cash forms. This transparency is non-negotiable. Furthermore, cherry-picking timeframes to show only positive performance while ignoring downturns is strictly prohibited. Your financial services content marketing must present a fair and balanced view of your firm’s capabilities and history.

Adhering to FINRA Rule 2210 for Broker-Dealer Communications

For broker-dealers, FINRA Rule 2210 governs communications with the public and sets a high bar for accuracy. The core tenet here is that communications must be fair, balanced, and not misleading. This means you must rigorously avoid promissory language. Phrases like “Guaranteed Returns,” “Risk-Free,” or “Beating the Market” are the quickest way to trigger an audit when executing a bank content marketing campaign.

When developing materials, you must implement a pre-publication approval loop. A designated principal must review static content before it goes live. This applies to website copy, whitepapers, and LinkedIn articles. For interactive content, such as social media replies or real-time chat, you need a robust post-review and archiving system. Tools like Smarsh or Hearsay Systems are essential entities in this workflow. They automatically archive every tweet, post, and comment to satisfy the rigorous record-keeping requirements demanded by regulators.

Managing Social Media Compliance and Archiving Workflows

The distinction between static and interactive content is vital for compliance officers and marketers alike. Your profile bio is static and requires pre-approval. Your replies to comments are interactive and generally require post-use review. However, a critical rule of engagement is that you must never reply to comments with specific investment advice. If a user asks, “Should I buy Tesla stock?”, your compliant response should be to direct them to a private consultation.

You must also be wary of “entanglement” and “adoption.” If you like or share a third-party article, regulators may view that as you adopting the content as your own. If that third-party article contains misleading claims, you are liable. Therefore, your financial services social media strategy must include strict guidelines on what third-party content can be shared.

Table 1: SEC Marketing Rule Comparison (Old vs. New)

| Feature | Old Rule (Pre-2021) | New SEC Marketing Rule (Rule 206(4)-1) |

| Testimonials | Strictly Prohibited | Allowed (with clear disclosures) |

| Endorsements | Prohibited | Allowed (must state if paid/unpaid) |

| 3rd Party Ratings | Restricted | Allowed (must disclose criteria & date) |

| Performance Data | Loose guidance | Strict (Must show net vs. gross returns) |

| Social Media | Viewed as “Static” ads | Interactive (Likes/Shares monitored) |

Audience Segmentation Strategy for Wealth Management Firms

Generic financial advice no longer ranks on search engines, and it certainly does not convert wealthy clients who have complex needs. A successful content marketing plan for financial services relies on hyper-segmentation. You must position your firm as the expert for a specific life stage, profession, or financial situation.

Creating Content to Generate High-Net-Worth Leads (HNWIs)

When targeting HNWIs, your wealth management content strategy must move beyond the basics of saving and budgeting. This audience does not need to know what a 401(k) is; they likely maxed theirs out years ago. They care about wealth preservation, tax-loss harvesting, intergenerational wealth transfer, and complex estate planning. Content for this segment should be sophisticated, data-rich, and exclusive.

Think exclusively in terms of “Commercial Intent” combined with “Expertise.” Articles like “Advanced Grantor Retained Annuity Trust (GRAT) strategies” or “Private Equity allocation for qualified purchasers” signal deep expertise. The tone should be understated and authoritative. How to generate high-net-worth leads often depends on using digital channels to validate your expertise before a prospect ever agrees to a golf outing or a dinner meeting. They will read your whitepapers and watch your market commentary to ensure your philosophy aligns with their goals.

Engaging HENRYs with Financial Literacy Content Strategies

The HENRY segment (High Earners, Not Rich Yet) typically includes tech professionals, doctors, and lawyers who have high incomes but low investable assets due to student debt, mortgages, or lifestyle costs. This is a prime target for content marketing for financial advisors who are building a future pipeline. These individuals are currently accumulating wealth and need guidance on how to structure it.

Content here should focus on lifestyle integration and specific professional challenges. Topics like “Managing RSUs for Tech Employees,” “Budgeting for a Jumbo Mortgage in San Francisco,” or “Backdoor Roth conversion guides for physicians” perform exceptionally well. Educational hubs that help them optimize their cash flow build loyalty early in their career. Brands like Betterment have excelled here by using a friendly, empowering tone that demystifies complex financial moves without condescension.

B2B Content Marketing for Banks and Commercial Lenders

For banks, the financial services marketing strategy often leans heavily into B2B. Business owners are looking for operational efficiency and capital. Content should focus on cash flow management, understanding SBA lending requirements, and merchant services optimization. A whitepaper titled “The 2025 Guide to Liquidity Management for Manufacturers” is far more valuable than a generic blog about “Why we love small business.”

Furthermore, business owners often have personal wealth tied up in their companies. Content that bridges the gap between commercial banking and private wealth management is highly effective. Articles discussing “Exit Planning Strategies for Founders” or “Key Person Insurance” can introduce commercial clients to your wealth management division, increasing the lifetime value of the client.

Addressing the Next Generation of Investors (Gen Z and Millennials)

The “Great Wealth Transfer” is underway, and younger generations consume content differently. They are skeptical of traditional institutions and rely heavily on social proof and digital research. For this demographic, your content must be mobile-first and bite-sized. Long-form articles should be supplemented with short-form videos that capture the essence of the topic.

Transparency is the key value for this group. Content that openly discusses fee structures, ethical investing (ESG), and digital user experience will resonate. They are looking for a partner who is tech-forward. Highlighting your mobile app features and digital onboarding processes within your content can be a major selling point.

SEO for Financial Services Firms: Building E-E-A-T and Topical Authority

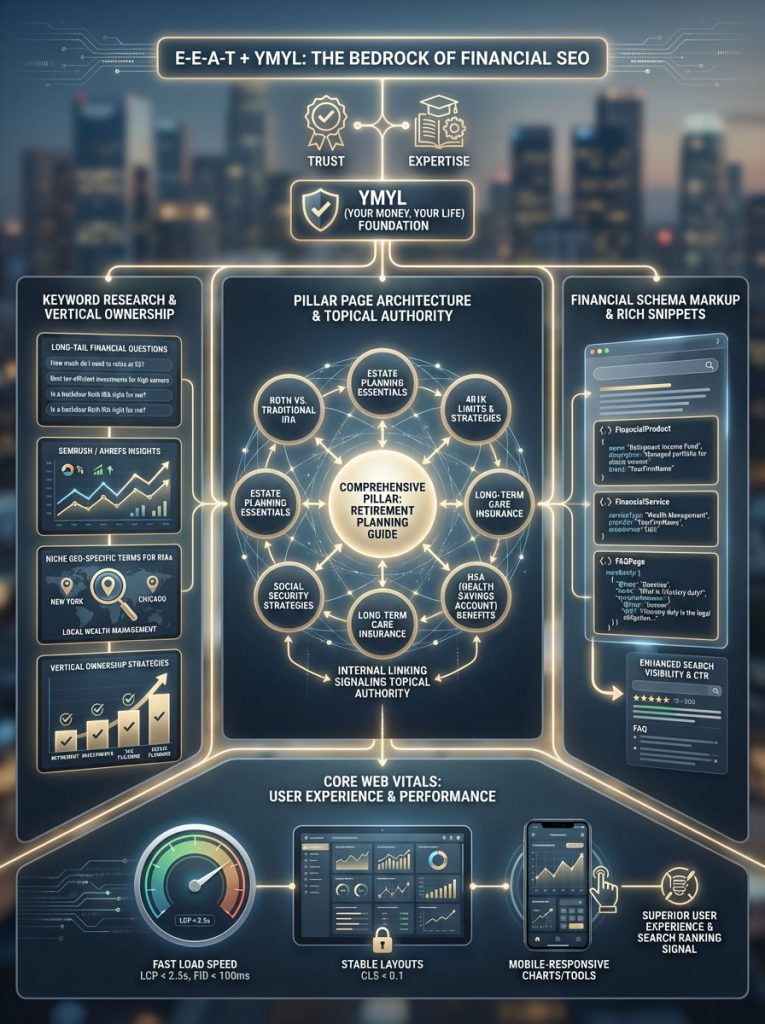

Search engines like Google have evolved significantly. They no longer just look for keywords; they look for “Topical Authority.” This is especially true in finance, which Google classifies as a “Your Money or Your Life” (YMYL) topic. To rank, your SEO for financial services firms strategy must demonstrate E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness).

Structuring Pillar Pages for Financial Services SEO

To build this authority, you must organize your content into clusters rather than publishing random articles. Start with a Pillar Page. This is a massive, comprehensive guide on a broad topic that serves as the anchor for your cluster. For example, you might write a 4,000-word “Complete Guide to Retirement Planning.” This page covers every aspect of the topic at a high level.

From there, you create cluster content. These are shorter, specific articles that target long-tail keywords and specific user questions. You might write “Roth vs. Traditional IRA for high earners,” “401k contribution limits 2025,” “Social Security withdrawal strategies,” and “Health Savings Accounts as retirement vehicles.” Each of these cluster pages links back to the main Pillar Page, and the Pillar Page links out to them. This internal linking structure tells search engines that your site is a complete library of information on retirement, boosting your ranking for the primary financial services content marketing terms.

Conducting Keyword Research for Financial Services and Long-Tail Queries

When conducting keyword research, look for questions rather than just broad terms. How to generate high-net-worth leads often starts with answering the specific questions these individuals ask in private. Use tools like Semrush or Ahrefs to find low-difficulty queries that competitors are ignoring.

You should balance your keyword portfolio. High-volume terms like “best savings account” are competitive for national banks and nearly impossible for smaller firms to rank for. Local RIAs should focus on geo-specific terms like “estate planning attorney in Austin” or niche terms like “financial planning for dentists.” This approach allows smaller firms to compete with giants by owning a narrow vertical of wealth management content strategy.

Implementing Financial Schema Markup for Rich Snippets

Technical SEO is just as important as the content itself. Implementing Schema markup helps search engines understand the context of your content. For financial services, using schemas like FinancialProduct, Service, or FAQPage can drastically improve your visibility.

When you use FAQPage schema on your educational guides, Google can pull your questions and answers directly into the search results. This increases your screen real estate and establishes you as an authority before the user even clicks. Ensure your technical team is implementing these tags correctly on all core service pages and major blog posts.

Optimizing for Core Web Vitals and Mobile Experience

Financial clients often check markets and news on their phones. If your site is slow or shifts unexpectedly (poor Cumulative Layout Shift), users will bounce. Google uses Core Web Vitals as a ranking factor. Ensure your content loads instantly, your charts and calculators are mobile-responsive, and your navigation is intuitive. A slow website signals a lack of technological competence, which is fatal for a financial brand.

High-Performing Content Formats for Financial Advisors and Banks

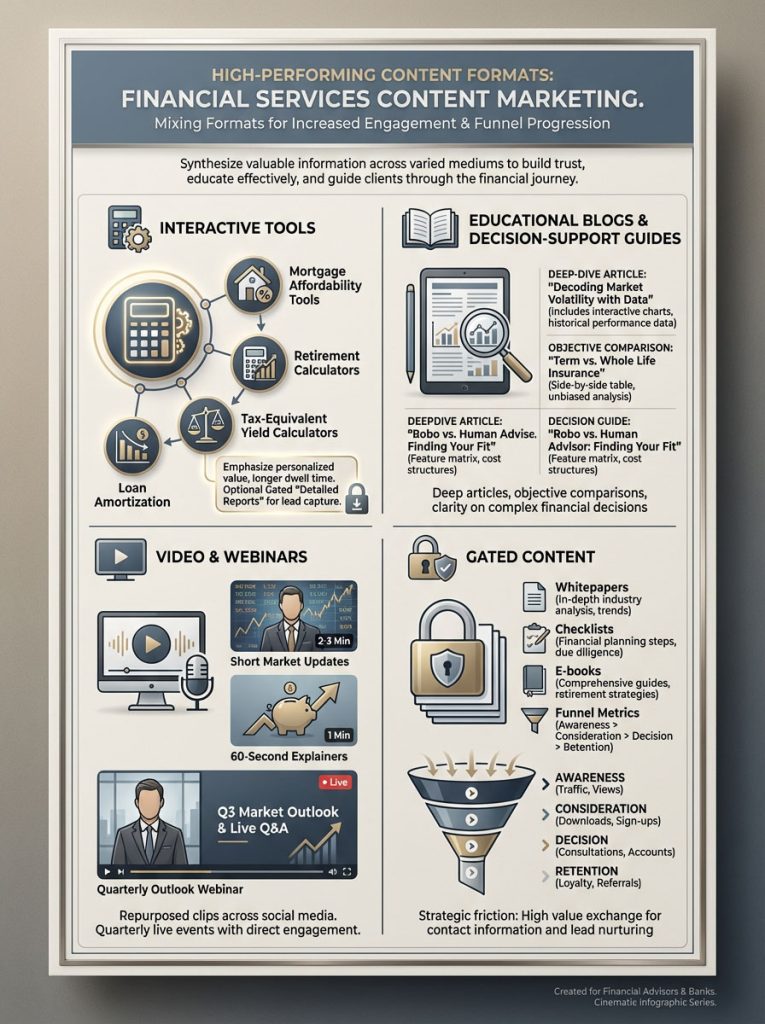

The format of your content is just as important as the information it contains. A wall of text is rarely engaging, especially when discussing complex financial regulations. The best financial services content marketing uses a mix of formats to keep users on the page and move them down the funnel.

Deploying Interactive Tools and Financial Calculators for Engagement

Interactive tools are the gold standard for engagement in the financial sector. Brands like Betterment and NerdWallet dominate search results because they provide tools that solve immediate problems. A “Retirement Savings Calculator,” “Mortgage Affordability Tool,” or “Tax-Equivalent Yield Calculator” provides personalized value that a static article cannot.

These tools increase “Dwell Time,” a key SEO metric. If a user spends five minutes playing with a calculator on your site, inputting their own data, Google interprets that as a sign of high quality. For a bank content marketing plan, creating a simple “Loan Amortization Schedule” tool can drive thousands of organic visits per month. Furthermore, these tools can be used as lead magnets; you can offer a “Basic” view for free and a “Detailed Report” in exchange for an email address.

Writing Educational Blogs and Decision-Support Guides

Blogs remain the foundation of financial education content strategy. However, they must go deep to be effective. A 500-word overview is no longer sufficient in a world of AI-generated content. Your articles should include charts, original data sources, and actionable takeaways.

When writing content marketing for financial advisors, focus on “Decision Support” content. This helps the reader make a choice between two options. Comparison articles like “Term vs. Whole Life Insurance,” “Robo-Advisor vs. Human Advisor,” or “Lump Sum vs. Dollar Cost Averaging” are powerful because they target users who are close to making a purchase decision. These articles should be objective, highlighting the pros and cons of each path, which builds trust.

Utilizing Video Marketing and Webinars for Advisor Trust

Video is essential for humanizing your brand. People buy from people, especially when money is involved. Short-form videos on platforms like YouTube Shorts or LinkedIn are excellent for quick market updates. A 60-second video explaining “Why the Fed raised rates today” or “What the new tax bill means for you” establishes you as an informed expert who is on top of current events.

For deeper engagement, use webinars. A quarterly market outlook webinar allows you to demonstrate your investment philosophy in real-time. This format is particularly effective for wealth management content strategy because it mimics the experience of a client meeting. You can take live Q&A, which demonstrates your expertise and ability to think on your feet. Record these sessions and repurpose them into blog posts, short clips, and podcast episodes.

Creating Gated Content and Whitepapers for Lead Generation

While blogs are great for awareness, you need gated content to capture leads. Whitepapers, e-books, and comprehensive guides are the standard here. A document titled “The 2025 Estate Planning Checklist for Business Owners” is valuable enough that a user will trade their email address for it.

Ensure your gated content delivers immense value. It should be professionally designed and filled with insights they cannot find for free on Google. Once they download the asset, they should be entered into a specific email nurture sequence relevant to that topic.

Table 2: Content Format by Funnel Stage

| Funnel Stage | User Intent | Best Content Formats | Key KPI |

| Top (Awareness) | “How do I save for a house?” | Blog Posts, Infographics, Social Videos | Traffic, Time on Page |

| Middle (Consideration) | “Best mortgage rates 2025” | Comparison Guides, Calculators, Webinars | Email Signups (MQLs) |

| Bottom (Decision) | “Hire financial advisor in [City]” | Case Studies, Whitepapers, Consultations | Booked Meetings (SQLs) |

| Retention (Loyalty) | “Market volatility update” | Client Newsletters, Exclusive Reports | Churn Rate, Upsells |

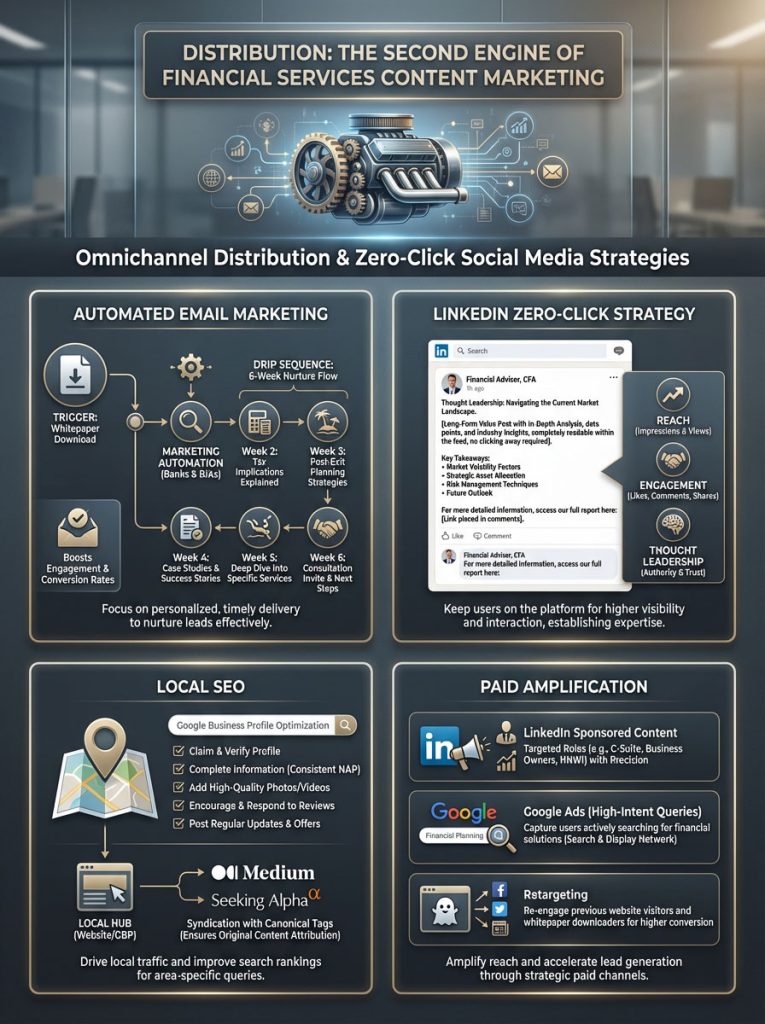

Omnichannel Distribution and Zero-Click Social Media Strategies

Creating content is only half the battle. You need a distribution strategy that gets your expertise in front of the right eyes. A modern content marketing plan for financial services moves beyond just posting a link on Twitter and hoping for the best.

Automating Email Marketing for Financial Services Lead Nurturing

Email marketing remains the highest ROI channel for financial services. It is a direct, owned line to your prospects that is not subject to algorithm changes. Use marketing automation for banks and RIAs to nurture leads systematically. When someone downloads a whitepaper, they should enter a drip campaign.

For example, if a user downloads a guide on “Selling Your Business,” they should receive a series of emails over the next six weeks. Email 1 delivers the guide. Email 2 discusses business valuation methods. Email 3 covers tax implications of a sale. Email 4 discusses life after the exit. Email 5 invites them to a consultation. This keeps your firm top-of-mind until they are ready to transact.

Mastering LinkedIn Content Strategy for Financial Advisors

For B2B and content marketing for financial advisors, LinkedIn is the primary social platform. The algorithm currently favors “Zero-Click” content. This means delivering the value directly in the post rather than forcing the user to click a link to your website.

Write a long-form post summarizing your latest market analysis. Use bullet points, emojis for structure, and clear headers within the post. If the content is good, users will engage with it directly, increasing your reach. You can place the link to the full article in the comments or your bio. This approach builds thought leadership and ensures your financial services marketing strategy reaches a broader audience who might not have time to click through to a blog.

Optimizing Local SEO for Banks and Wealth Management Branches

Don’t let your content live on an island. Syndicate your best articles on platforms like Medium, Seeking Alpha, or industry portals. Ensure you use a canonical tag to tell Google that the original version is on your website. This drives referral traffic and builds high-quality backlinks.

For local banks and advisors, Local SEO is critical. Optimize your Google Business Profile. Post updates directly to your profile regarding community events, financial literacy workshops, or new team members. Ensure your name, address, and phone number (NAP) are consistent across the web. When someone searches for a “financial advisor near me,” your local presence and reviews are the deciding factors.

Leveraging Paid Amplification for Content Reach

Organic reach is powerful, but it can be slow. To accelerate your financial services content marketing, use paid media to amplify your best-performing pieces. You don’t need to sell directly in the ad. Instead, promote your educational content.

Run LinkedIn Sponsored Content campaigns targeting specific job titles (e.g., “Surgeons,” “CEOs,” “Founders”) with your whitepapers. Run Google Search Ads for high-intent keywords like “Financial Advisor for Medical Professionals.” Retargeting is also effective; if someone visited your “Retirement Planning” page, show them an ad for your “Retirement Checklist” download as they browse other sites.

Integrating Generative AI and MarTech in Financial Content Operations

Executing a high-volume content marketing plan for financial services requires robust operations. You need the right tech stack to manage the “Content Supply Chain” from ideation to compliance approval.

Using Generative AI for SEO While Mitigating Compliance Risks

Generative AI can be a powerful accelerator if used correctly. Generative AI for SEO helps in brainstorming topics, creating outlines, and summarizing complex reports. Ally Financial and other leaders have successfully used AI to streamline their marketing operations.

However, you must be cautious. AI can “hallucinate” facts and numbers. Never ask ChatGPT to write a market commentary without strictly verifying every data point. Use AI to create the first draft, to repurpose a webinar transcript into a blog post, or to write meta descriptions. Always have a human expert review the final output to ensure accuracy, tone, and compliance. This blend of AI efficiency and human oversight is the future of financial services content marketing.

Selecting the Best Content Marketing Tools for Financial Services

Your stack should include a Content Management System (CMS) like HubSpot or WordPress. For compliance, tools like Global Relay or Smarsh are non-negotiable for archiving. For analytics, PathFactory or Google Analytics 4 (GA4) will help you track user behavior.

Integration is key. Your CMS should talk to your CRM. When a prospect engages with your financial literacy content, your sales team should know. This data allows advisors to reach out with context, knowing exactly what topics the prospect is interested in. If a prospect reads three articles on “401k Rollovers,” the advisor knows exactly how to start the conversation.

Developing a Content Governance Framework

With multiple authors, compliance constraints, and various channels, governance is essential. Create a “Content Style Guide” that outlines your brand voice, prohibited terms (promissory language), and formatting rules. Establish a clear workflow: Ideation > SEO Brief > Drafting > Editorial Review > Compliance Review > Staging > Publication.

Assign clear roles. Who owns the SEO strategy? Who is the final sign-off for compliance? Having these roles defined prevents bottlenecks and ensures a consistent flow of high-quality content.

Measuring the ROI of Content Marketing in Financial Services

Vanity metrics like “likes,” “shares,” and “pageviews” do not pay the bills. To justify the budget for your content marketing plan for financial services, you must track financial KPIs that tie back to revenue.

Tracking MQLs and SQLs in Financial Marketing Funnels

A Marketing Qualified Lead (MQL) is someone who has engaged with your content significantly, perhaps by downloading a “Tax Planning Guide” or subscribing to your newsletter. They are interested but maybe not ready to buy. A Sales Qualified Lead (SQL) is someone who has taken a direct action indicating intent to do business, such as requesting a consultation, booking a discovery call, or starting an account application.

Track the conversion rate between these stages. If you are generating thousands of MQLs but zero SQLs, your content may be too basic or you may be targeting the wrong audience. You may need to introduce more bottom-funnel content like case studies, “Why Us” pages, or webinar replays to drive the ROI of content marketing in financial services.

Analyzing Cost Per Acquisition and AUM Influenced Metrics

For wealth managers, the ultimate metric is “Assets Under Management (AUM) Influenced.” This tracks how much new revenue can be attributed to content touchpoints. Did a $2 million client read your blog on “Estate Taxes” before signing? Sophisticated attribution modeling can help you understand the customer journey.

For banks, a key metric is Cost Per Qualified Joint Account (CQJA) or Cost Per Funded Account. This measures the marketing spend required to open a new funded account. By tracking these hard metrics, you can prove that your financial services content marketing is a revenue generator, not a cost center.

Monitoring Brand Sentiment and Share of Voice

In finance, reputation is everything. Monitor your “Share of Voice” for key topics against your competitors. Are you the dominant voice for “Family Office Services in Chicago”? Use social listening tools to track brand sentiment. Are people speaking positively about your educational resources? Positive sentiment builds the trust required for financial transactions.

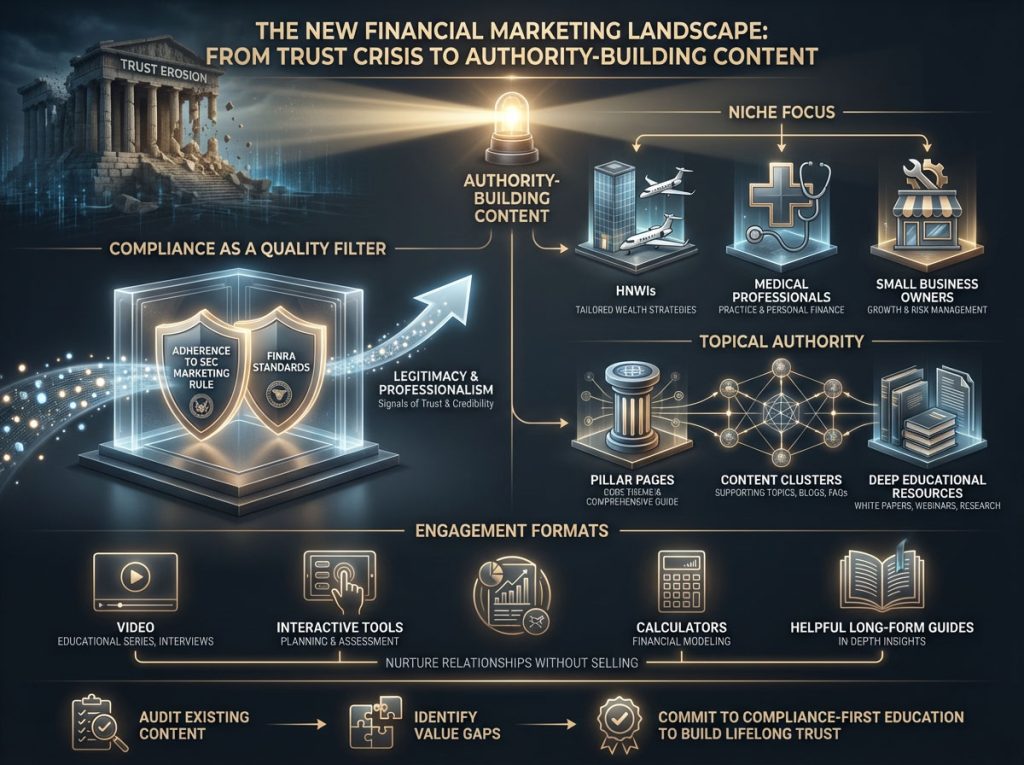

Summary & Key Takeaways

The landscape of financial marketing has shifted permanently. The “Trust Crisis” means that consumers are more skeptical than ever. A robust content marketing plan for financial services is your answer to this skepticism. It allows you to demonstrate expertise, build authority, and nurture relationships at scale without being “salesy.”

Remember that compliance is not a barrier; it is a quality filter. By adhering to the SEC Marketing Rule and FINRA compliance, you signal to clients that you are a legitimate, trustworthy entity. Focus on your niche, whether it is HNWIs, medical professionals, or small business owners. Build topical authority through pillar pages and clusters. Use video and interactive tools to engage users deeply.

Ultimately, the goal is to be the helpful voice in a noisy world. When you educate your audience without expecting an immediate return, you build the kind of trust that leads to lifelong client relationships. Start your journey today by auditing your existing content, identifying the gaps where you can add real value, and committing to a culture of compliance-first education.

Frequently Asked Questions (FAQ)

What is the most effective content marketing strategy for banks?

The most effective strategy focuses on hyper-local SEO and financial literacy. Banks should create content that answers specific local questions, such as “small business loans in [City]” or “first-time homebuyer grants in [State].” Combining this with interactive tools like mortgage calculators drives high engagement and builds trust with retail customers who are researching online before visiting a branch.

How can financial advisors use testimonials under the new SEC rule?

Advisors can now use testimonials if they comply with the SEC Marketing Rule (Rule 206(4)-1). You must clearly disclose whether the testimonial comes from a current client, if any compensation was provided (cash or non-cash), and if there are any conflicts of interest. The presentation must be fair and balanced, avoiding any misleading implications about performance or cherry-picked success stories.

What topics should wealth management firms write about to attract HNWIs?

High-net-worth individuals are interested in wealth preservation and complex financial maneuvers rather than basic savings tips. Topics should include estate planning strategies, tax-loss harvesting, philanthropic giving structures (like Donor-Advised Funds), private market investments, and intergenerational wealth transfer. Avoid generic advice; focus on sophisticated, expert-level insights that demonstrate deep competency.

How do I ensure my financial content is FINRA compliant?

To ensure FINRA compliance, avoid all promissory language like “guaranteed returns,” “risk-free,” or “market-beating.” Implement a workflow where a registered principal reviews and approves static content before publication. For interactive social media, use an archiving tool like Smarsh or Hearsay Systems to retain records of all communications for audit purposes and ensure no specific investment advice is given in comments.

Why is SEO important for financial services firms?

SEO is critical because the majority of financial research begins with a search engine. High-intent queries like “financial advisor near me” or “best retirement plans for self-employed” drive qualified traffic. Ranking for these terms establishes your firm as a credible authority, which is essential for converting users in the YMYL (Your Money or Your Life) sector where trust is paramount.

What is the difference between an MQL and an SQL in financial marketing?

An MQL (Marketing Qualified Lead) is a user who has indicated interest, such as by downloading a whitepaper or subscribing to a newsletter. An SQL (Sales Qualified Lead) is a prospect who has taken a direct action indicating intent to do business, such as requesting a consultation or booking a discovery call. The goal of your content is to nurture MQLs with valuable information until they are ready to become SQLs.

How often should a financial institution publish new content?

Consistency is key for building topical authority and retaining audience attention. Aim to publish at least one high-quality, long-form article (1,500+ words) per week. Supplement this with daily or weekly social media updates and a monthly client newsletter. Regular publishing signals to search engines that your site is active and relevant, and it keeps your brand top-of-mind for clients.

Can AI write compliant financial advice content?

AI should not be used to write final financial advice content due to the risk of “hallucinations” or inaccuracies. However, AI is excellent for brainstorming topics, creating outlines, and summarizing data. All AI-generated content must be rigorously reviewed by a human expert and a compliance officer to ensure it meets regulatory standards and aligns with your firm’s investment philosophy.

What are the best tools for financial services content marketing?

Top tools include HubSpot for CRM and marketing automation, Semrush or Ahrefs for keyword research and SEO analysis, and compliance archiving platforms like Global Relay or Hearsay Systems. For content creation, tools like Canva for visuals and Grammarly for editing are also standard. Financial-specific tools like YCharts can help create accurate charts and graphs for your content.

How do I measure the ROI of content marketing for my RIA?

Measure ROI by tracking “Assisted Conversions” and “Attribution” in your analytics platform. Look at how many funded accounts or booked meetings originated from users who engaged with your content. Calculate the Cost Per Acquisition (CPA) for these clients and compare it to the Lifetime Value (LTV) of a client to determine profitability.

What is a “Zero-Click” content strategy on LinkedIn?

A “Zero-Click” strategy involves posting valuable, standalone content directly on LinkedIn without requiring the user to click a link to leave the platform. This aligns with LinkedIn’s algorithm, which favors native content. The goal is to build brand awareness and engagement within the feed, establishing thought leadership that eventually leads to inbound inquiries and profile visits.

How does E-E-A-T impact financial websites?

E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness) is a major ranking factor for financial websites. Google scrutinizes financial content more heavily to protect users. To rank well, you must display clear author credentials (like CFA, CFP), cite reputable sources, ensure site security (HTTPS), and maintain a positive brand reputation. High E-E-A-T signals to Google that your content is safe and reliable for users making financial decisions.

Disclaimer:

The information provided in this article is for educational and informational purposes only and does not constitute legal, financial, or investment advice. Marketing regulations, including SEC and FINRA rules, are subject to change. Financial services firms should consult with their internal compliance departments or legal counsel before implementing new marketing strategies to ensure full adherence to current laws and regulations.

References:

- U.S. Securities and Exchange Commission. (2020). Investment Adviser Marketing (Release No. IA-5653).

- FINRA. (n.d.). Rule 2210. Communications with the Public.

- Capgemini. (2024). World Wealth Report.

- Google Search Central. (2024). Creating helpful, reliable, people-first content.