U.S. Wall Street futures are signaling a robust start to the month, buoyed by powerful investor optimism in artificial intelligence and a significant, albeit temporary, trade truce between the United States and China. This rally reflects a market increasingly confident that massive AI technology investment is translating into tangible corporate earnings and productivity gains.

Table of Contents

This is more than just a financial headline; it’s a critical indicator of capital flow, technological priorities, and the competitive landscape for digital marketing and AI professionals in the USA. The powerful wave of emerging AI stock market trends is pushing the market upward, while geopolitical tensions and macroeconomic uncertainties create significant crosswinds. This article dissects these forces, providing a strategic roadmap for specialists navigating the convergence of technology, finance, and global politics. The prevailing Wall Street AI optimism is reshaping investment strategies and corporate priorities alike.

Decoding the AI-Fueled Market Rally: From Capital Expenditure to Corporate Earnings

The current market enthusiasm is fundamentally different from the speculative hype of past tech bubbles. Today’s Wall Street AI optimism is anchored in a concrete foundation: verifiable, multi-billion-dollar capital expenditures that are directly fueling record-breaking cloud revenue and accelerating enterprise adoption of AI. Investors are no longer just betting on a concept; they are rewarding tangible results, a crucial distinction that underpins the current AI stock market trends. This shift from promise to performance is what makes the ongoing rally so compelling and signals a mature phase in artificial intelligence investing.

The “Magnificent Seven” Earnings Report: Separating the Winners from the Watchlist

The third-quarter earnings season has been a litmus test for the tech giants, clearly delineating which companies are successfully monetizing their massive AI technology investment. The results reveal a nuanced landscape where strategic execution, not just spending, dictates market reaction. Understanding these divergences is key to grasping the real AI stock market trends.

The Cloud Titans: Monetization in Full Swing

Alphabet (Google) and Amazon have emerged as clear frontrunners, demonstrating that their colossal investments in AI infrastructure are paying off.

- Alphabet (Google): The company reported its first-ever $100 billion quarter, a monumental achievement. The standout performer was Google Cloud, which saw its revenue climb an astonishing 34%, a testament to the surging demand for its AI and machine learning services.

- Amazon: After a period of slowing growth, Amazon Web Services (AWS) showcased a significant reacceleration, posting 20% growth. This revival is directly credited to the company’s aggressive data center expansion and the successful rollout of its own AI chips, Trainium and Inferentia, which are attracting a new wave of AI development.

The Scrutinized Spenders: High Costs Raise Questions

Conversely, companies like Meta Platforms are facing a more skeptical market. Despite beating revenue expectations, the company’s stock came under pressure due to soaring AI-related costs and a one-time tax charge. This highlights a critical theme in the current Wall Street AI optimism: investors demand a clear and believable path to profitability for every dollar spent on AI. The era of unchecked spending is over; the era of AI automation ROI has begun. The Magnificent Seven AI spending strategies are now under a microscope.

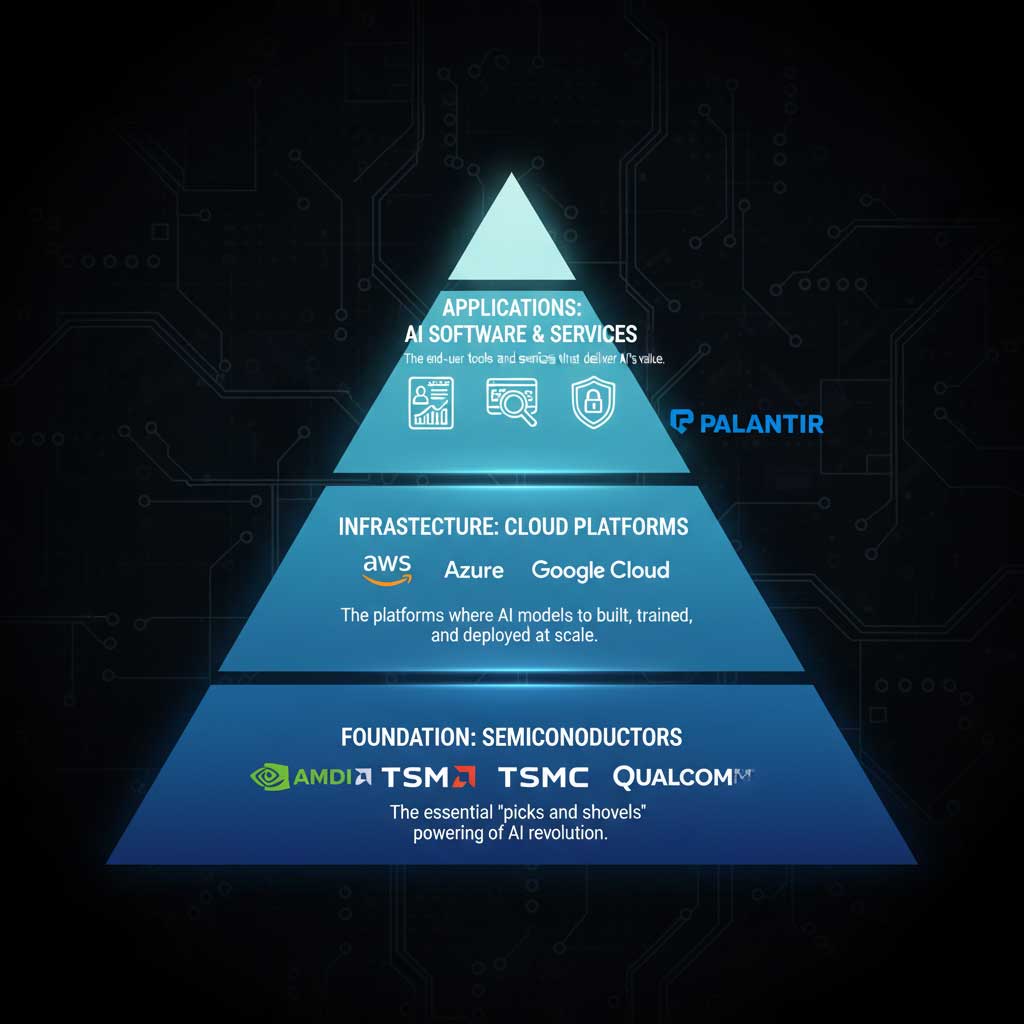

The “Picks and Shovels” Play: Why the Semiconductor Stocks Outlook Remains Bullish

The foundational layer of the AI revolution is built on silicon. This makes the semiconductor stocks outlook one of the most reliable barometers of the industry’s health. These companies provide the essential “picks and shovels” for the AI gold rush, making their performance a leading indicator of future growth and a cornerstone of any artificial intelligence investing portfolio.

Nvidia has become the poster child for this phenomenon, with its market valuation soaring past $5 trillion on the back of overwhelming demand for its H100 and A100 GPUs. These chips are the undisputed workhorses for training large language models. However, the ecosystem is expanding.

- AMD (Advanced Micro Devices): The company is mounting a serious challenge with its MI300X accelerator, designed to compete directly with Nvidia’s top-tier offerings in the data center.

- Qualcomm: While known for mobile chips, Qualcomm is carving out a crucial niche in edge AI with its powerful Neural Processing Units (NPUs), enabling sophisticated AI applications to run directly on smartphones and other devices.

Investor attention is now keenly focused on the upcoming earnings from software analytics firm Palantir Technologies, which is seen as a bellwether for enterprise AI software demand. Its performance will provide critical insights into whether the hardware boom is translating into widespread software adoption.

The Geopolitical Tightrope: Analyzing the US-China Trade AI Impact

The fragile truce in the US-China trade war has injected a dose of much-needed stability into the global tech ecosystem. However, to view this as a resolution would be a strategic error. It is a tactical pause in a long-term competition for technological supremacy. A deep understanding of the US-China trade AI impact is therefore non-negotiable for anyone involved in the tech sector, as it directly influences everything from hardware availability to long-term AI technology investment strategies.

A Fragile Truce: What the Tariff Delay and Chip Exemptions Mean for the AI Supply Chain

The agreement to delay a new round of reciprocal tariffs for one year has provided immediate relief to frayed supply chains. For the AI industry, the most significant developments are more specific.

Recent adjustments to the Nvidia AI chip restrictions are particularly noteworthy. The U.S. Commerce Department has clarified rules that will allow Nvidia to resume sales of certain modified, lower-performance AI GPUs to China. While this prevents China from accessing the most advanced technology for military purposes, it allows Nvidia to continue tapping into a lucrative commercial market, a move that pleased investors.

Furthermore, China’s temporary suspension of export controls on several critical rare earth elements has been a welcome reprieve for Western manufacturers. These materials are indispensable for producing everything from electric vehicles to advanced sensors, and the move has helped stabilize input costs.

Beyond Tariffs: The Long-Term Battle for Technological Supremacy and Its Risks

The current détente does not alter the fundamental trajectory of the US-China relationship. The core of the conflict has shifted from trade deficits to a fierce competition for dominance in foundational technologies of the 21st century: artificial intelligence, quantum computing, and biotechnology.

This underlying tension presents persistent risks. The potential for future “supply chain weaponization”—where access to critical components or materials is used as a political lever—remains high. This geopolitical risk must be factored into any long-term artificial intelligence investing thesis, forcing companies to diversify their manufacturing bases and investors to demand a premium for assets heavily exposed to single-source suppliers. The US-China trade AI impact will be a defining narrative for years to come.

Strategic Implications for Digital Marketing and AI Professionals

The macroeconomic and geopolitical currents shaping Wall Street have a direct and profound impact on the daily realities of digital marketing and AI professionals. The flood of capital reshaping AI stock market trends is the same capital that funds the development of the tools, platforms, and frameworks that define the modern marketing landscape. A strategic marketer today must also be a savvy market analyst.

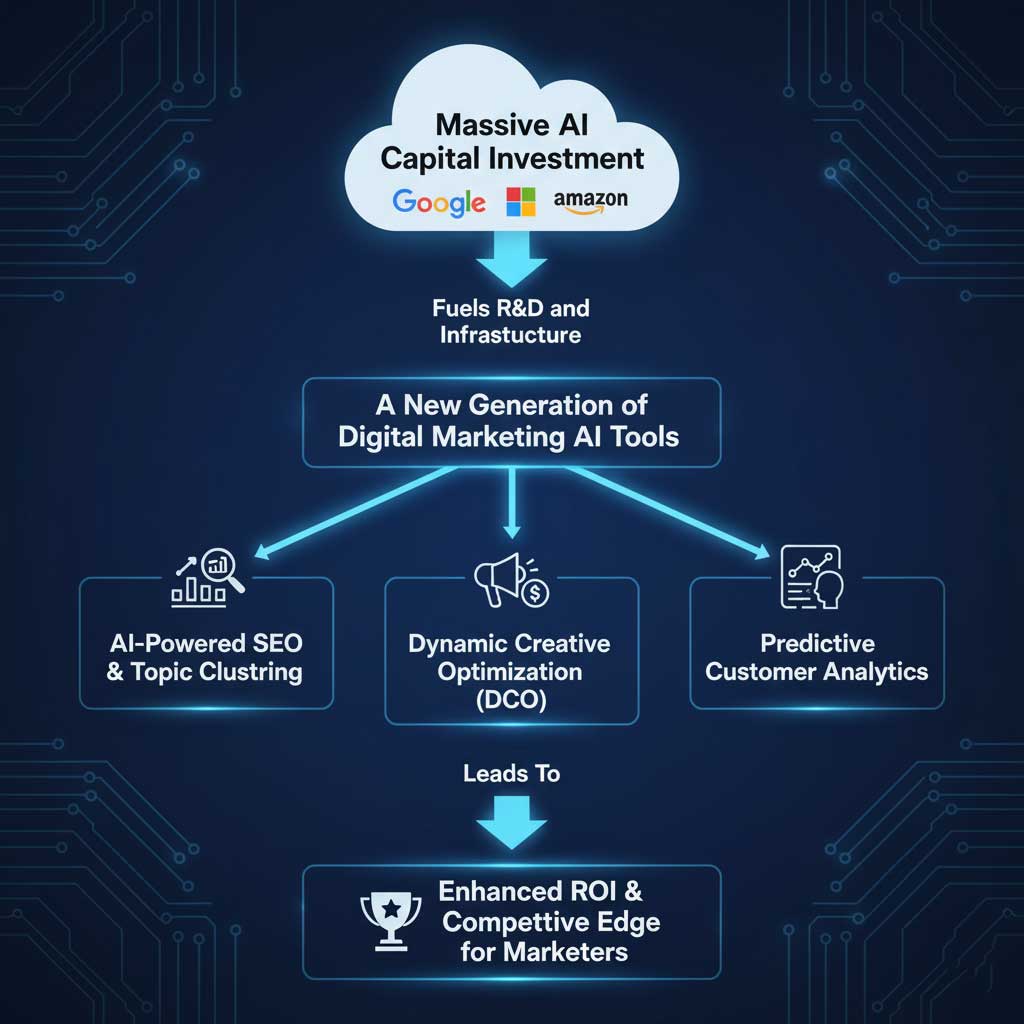

The MarTech Injection: How AI Investment is Fueling a New Generation of Digital Marketing AI Tools

The billions of dollars being poured into data centers by Google, Microsoft, and Amazon are not just for their own benefit. This massive infrastructure buildout is the engine powering a new generation of sophisticated digital marketing AI tools. The generative AI market growth is a direct result of this investment cycle.

- AI-Powered SEO: Tools like MarketMuse and SurferSEO are using advanced AI to move beyond simple keyword matching, enabling sophisticated topic clustering, semantic analysis, and content optimization that aligns with how modern search engines understand context.

- Dynamic Creative Optimization (DCO): In advertising, AI platforms can now generate and test thousands of ad variations in real-time, tailoring visuals, copy, and calls-to-action to individual users, dramatically improving conversion rates.

- Predictive Analytics: AI-driven CRM platforms can now predict customer churn, identify high-value leads, and personalize marketing communications at a scale previously unimaginable, maximizing AI automation ROI.

Navigating the MarTech Stock Landscape and Cloud Computing Opportunities

For professionals looking to invest in the space they know best, understanding the financial health of the MarTech ecosystem is crucial. When analyzing MarTech stocks from companies like HubSpot or Adobe, it’s essential to look beyond top-line revenue and examine their R&D spending on AI. Companies that are integrating generative AI deeply into their core products are best positioned for future growth.

Furthermore, a cloud computing stock analysis offers a powerful proxy for the health of the entire AI adoption cycle. The continued, robust growth of AWS, Azure, and Google Cloud is the clearest signal that enterprises are not just experimenting with AI but are actively deploying it at scale.

Budgeting and Strategy Amid Economic Uncertainty: Interpreting the Fed Policy on Tech Stocks

The macroeconomic environment adds another layer of complexity. The Federal Reserve’s decisions on interest rates have a direct impact on the tech sector. The recent rate cut to a range of 3.75%-4.00% was intended to support a weakening labor market, but Fed Chair Jerome Powell’s cautious forward guidance has tempered expectations of further easing.

This Fed policy on tech stocks matters because lower rates generally increase the valuation of growth companies by making their future cash flows more valuable today. Uncertainty around the Fed’s path can lead to market volatility, which in turn can impact marketing budgets and hiring plans. The ongoing delay in official government economic data has forced a greater reliance on private indicators like the ADP payrolls report to gauge the economy’s health, making strategic planning more challenging.

Data-Driven Deep Dive: The Numbers Behind the News

To fully grasp the forces shaping the market, it’s essential to look at the hard data. The following tables provide a snapshot of the strategic landscape, from the performance of the tech giants to the critical players underpinning the entire AI ecosystem. This data-driven approach is vital for any credible tech stocks forecast 2025.

Comparison: Magnificent Seven AI Strategy & Q3 Performance

This table offers a side-by-side look at how the different AI strategies of the top tech companies are being received by the market, providing a clear view of the current Magnificent Seven AI spending landscape.

| Company | Primary AI Initiative | Key Q3 Metric | Post-Earnings Stock Reaction | Analyst Outlook |

| Alphabet (Google) | Integrating Generative AI into Search & Cloud | 34% Google Cloud Growth | Positive | Strong Buy |

| Amazon | AWS AI Services & Data Center Expansion | 20% AWS Growth (Reacceleration) | Positive | Strong Buy |

| Microsoft | OpenAI Partnership & Azure AI Dominance | 26% Azure Growth | Neutral/Slightly Negative | Buy |

| Nvidia | H100 GPU for AI Training | Record Data Center Revenue | Strongly Positive | Strong Buy |

| Meta Platforms | Metaverse & Llama 2 Open Source Model | Soaring AI-related Costs | Negative | Hold/Buy |

| Apple | On-Device AI & Neural Engine | Cautious on AI Spending | Neutral | Buy |

| Tesla | Autonomous Driving (FSD) & Optimus Robot | FSD Beta Development | Mixed | Hold |

The AI Supply Chain: Key Semiconductor Players and Their Role

This table breaks down the essential hardware ecosystem, illustrating why the semiconductor stocks outlook is so central to the broader AI stock market trends.

| Company | Core Product | Role in AI Ecosystem | Market Position |

| Nvidia | GPUs (H100/A100) | The “Gold Standard” for AI Model Training | Dominant Leader (80%+ Market Share) |

| AMD | GPUs (MI300X) / CPUs | Primary Challenger to Nvidia in AI Training | Strong Challenger |

| Intel | CPUs / Gaudi AI Accelerators | Legacy Leader in CPUs, Growing AI Presence | Niche Player in AI Accelerators |

| Qualcomm | NPUs (Neural Processing Units) | Leader in On-Device (“Edge”) AI for Mobile | Dominant in Mobile |

| Broadcom / VMware | Networking & Custom Silicon | Provides Critical Networking for Data Centers | Key Infrastructure Player |

| TSMC | Chip Manufacturing | Manufactures Chips for Nvidia, AMD, Apple | Essential Foundry Partner |

Summary & Key Takeaways: A Tech Stocks Forecast for 2025

The prevailing Wall Street AI optimism is not an irrational frenzy; it is a calculated response to a technological paradigm shift backed by unprecedented corporate investment and tangible revenue growth. The current market momentum, however, is being navigated through a complex environment of geopolitical fragility and macroeconomic uncertainty. For specialists and investors, the key is to look past the daily headlines and focus on the underlying fundamentals. The long-term AI stock market trends appear robust.

Key Takeaways:

- Earnings-Driven Rally: The current AI boom is fundamentally different from past bubbles. It is backed by substantial earnings and revenue from cloud services and semiconductor sales, making the AI technology investment thesis more solid.

- Geopolitical Fragility: The US-China trade AI impact remains a critical variable. The current truce is a positive but temporary development, and long-term supply chain risks must be factored into any strategic planning or artificial intelligence investing decision.

- Actionable Intelligence: For professionals, this market trend directly impacts the quality and availability of digital marketing AI tools. It also creates unique investment opportunities within the broader MarTech and cloud computing ecosystems.

- Watch the Fed: Macroeconomic policy, particularly the Fed policy on tech stocks, will remain a critical factor. Interest rate decisions will continue to influence valuations and the cost of capital, impacting the growth trajectory of the entire tech sector.

Looking ahead, the tech stocks forecast for 2025 suggests that companies capable of demonstrating clear and compelling AI automation ROI will continue to outperform. The focus will increasingly shift from who is spending the most to who is executing most effectively.

FAQs (Frequently Asked Questions)

What is driving the current optimism in Wall Street futures?

The optimism is driven by two main factors: strong corporate earnings from tech giants showing clear returns on their AI investments, and a temporary trade truce between the U.S. and China that has eased immediate concerns about supply chain disruptions and tariffs.

How is the “Magnificent Seven’s” AI spending impacting their stock performance?

The impact varies. Companies like Google and Amazon, which are showing strong revenue growth in their cloud divisions directly linked to AI, have seen their stocks rewarded. In contrast, companies like Meta are facing investor scrutiny over massive spending without a clear, immediate path to profitability from their AI ventures.

What does the US-China trade truce actually mean for the semiconductor industry?

It provides significant short-term relief. It has allowed companies like Nvidia to resume selling certain modified AI chips to China and has stabilized the supply of critical rare earth materials needed for manufacturing. However, it does not resolve the long-term geopolitical competition over technological leadership.

Why does the semiconductor stocks outlook remain strong despite economic uncertainty?

The outlook remains strong because semiconductors are the essential hardware—the “picks and shovels”—powering the AI revolution. Massive, ongoing capital expenditures on data centers by global cloud providers create a sustained, high-margin demand for these advanced chips, largely insulating the sector from broader economic cyclicality.

How does the Federal Reserve’s interest rate policy specifically affect tech stocks?

Lower interest rates are generally beneficial for tech stocks. They reduce the cost of borrowing for growth and increase the present value of future earnings, which boosts valuations. The Fed’s recent rate cut is supportive, but uncertainty about the timing and extent of future cuts can create market volatility.

Is now a good time to begin artificial intelligence investing?

While AI stocks offer significant long-term growth potential, many also trade at very high valuations. The current environment favors companies providing foundational AI infrastructure (semiconductors, cloud computing). Investors should conduct thorough research and consider the inherent risks, including high competition and potential market corrections.

Will AI spending by big tech create another market bubble?

There are valid concerns that the massive capital expenditures could lead to a bubble if the investments don’t generate proportional returns. However, many analysts believe this cycle is different from the dot-com era because the spending is funded by strong corporate earnings and is already driving tangible productivity gains and revenue.

How can my business leverage the generative AI market growth for better ROI?

Businesses can leverage generative AI to automate content creation for marketing, personalize customer service interactions with intelligent chatbots, optimize supply chains with predictive analytics, and accelerate product development by using AI for coding and design. The key is to focus on applications that solve a specific business problem.

Are semiconductor stocks like Nvidia overvalued due to the current AI hype?

Valuations are undeniably high, with companies like Nvidia trading at a significant premium. This valuation is justified by projections of continued exponential growth in AI infrastructure demand. Any sign of a slowdown in this demand or an increase in effective competition could challenge these lofty valuations.

What are the biggest risks to the AI stock market trends in the coming year?

The biggest risks include a potential re-escalation of US-China trade tensions, a more restrictive monetary policy from the Federal Reserve, signs that corporate AI spending is slowing down, and the emergence of a new, disruptive technology that could shift the competitive landscape.

How should a digital marketer prepare for the next wave of AI-powered tools?

Marketers should focus on developing skills in data analysis, prompt engineering, and strategic thinking. They should actively experiment with new AI tools for content creation, SEO, and advertising, and learn to interpret the data-driven insights these platforms provide to make more effective decisions.

Which sectors outside of pure tech are benefiting most from AI technology investment?

Healthcare is a major beneficiary, with AI being used for drug discovery and diagnostic imaging. The financial services industry is using AI for fraud detection and algorithmic trading. Additionally, the automotive sector is heavily investing in AI for the development of autonomous driving systems.