October’s sharp drop in job postings signals a cooling U.S. labor market, compelling digital marketers to urgently shift budgets and strategies. With the Indeed Job Postings Index at a 20-month low and official BLS data delayed, marketers must now pivot from broad hiring-related ad spend to high-intent, performance-focused campaigns. This new landscape prioritizes first-party data, AI-driven cost efficiencies, and agile responses to retain ROI amidst economic uncertainty. The current environment demands a fundamentally smarter digital marketing strategy for the job market slowdown, one grounded in real-time data and ruthless efficiency.

Table of Contents

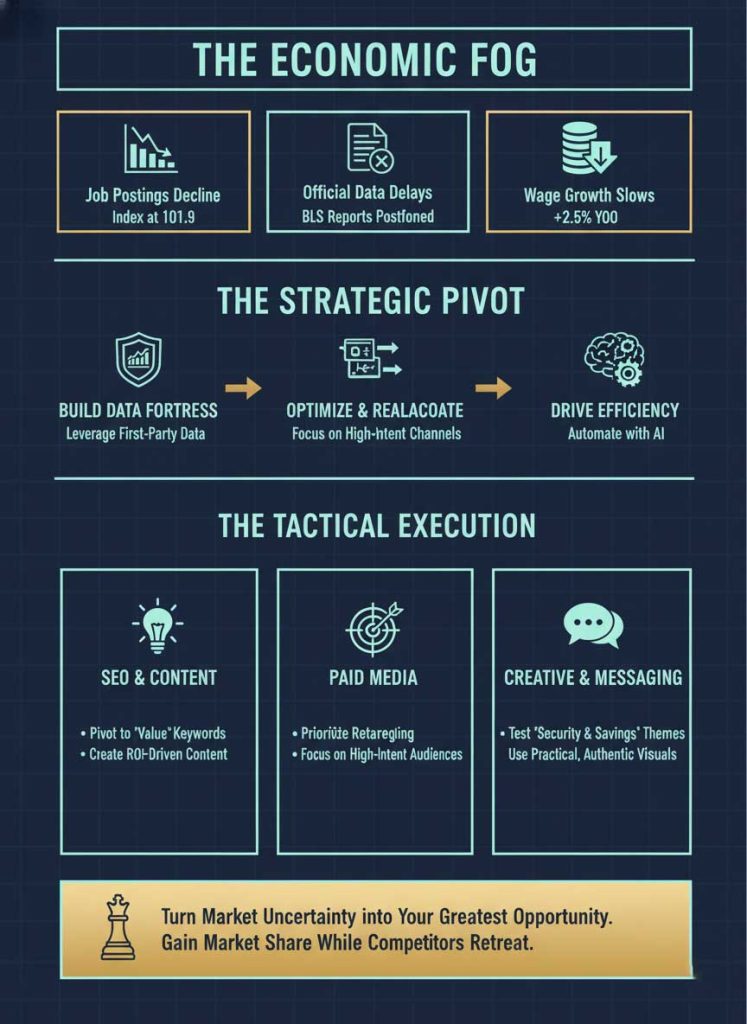

The economic crosswinds of late 2025 have created a perfect storm of uncertainty. For digital marketing leaders, the old playbooks built for a high-growth, candidate-driven market are proving obsolete. The simultaneous decline in hiring demand, a slowdown in wage growth, and a government shutdown-induced delay in official Bureau of Labor Statistics (BLS) reports have left many navigating a dense data fog. This isn’t just a minor challenge; it’s a critical inflection point that requires a new framework for action.

This article provides a data-driven, step-by-step playbook for marketers to not only survive but thrive in this evolving environment. We will dissect the key economic indicators that matter now, provide a framework for leveraging your own first-party data as a north star, and outline actionable tactics for budget reallocation, creative optimization, and AI-driven efficiency. The goal is to protect your ROI, outmaneuver less agile competitors, and capture valuable market share when others are pulling back.

Decoding the Data: What October’s Economic Signals Mean for Marketers

To navigate uncertainty, you must first understand the landscape. The latest economic data provides clear signposts that translate directly into marketing intelligence. Understanding the impact of job postings decline on marketing budgets begins with interpreting these core signals correctly.

The Canary in the Coal Mine: Indeed Job Postings Index Falls to 101.9

The Indeed Job Postings Index, a real-time measure of labor market activity, recently fell to 101.9—its lowest point since February 2021. This is a leading indicator, meaning it signals future economic trends before they appear in lagging government reports.

For marketers, the Indeed Job Postings Index marketing implications are twofold. First, it signals a sharp drop in demand for recruitment advertising, which may lower CPCs in job-related search queries. Second, and more importantly, it means businesses are reallocating their own budgets away from hiring and toward efficiency and customer acquisition, intensifying competition for bottom-of-funnel commercial keywords.

Flying Blind? Why Delayed BLS Reports Make First-Party Data a Strategic Imperative

Compounding the issue is a government shutdown that has postponed the release of crucial BLS reports. Marketers who rely on this monthly data to gauge economic health are now effectively flying blind. This data vacuum makes a pivot to internal metrics not just a good idea, but a strategic necessity.

The search for substitute economic data for BLS marketers must end with your own CRM and analytics platforms. Your first-party data—from website traffic and lead velocity to sales cycle length and customer churn—is now the most reliable, high-frequency indicator of your business’s health and your customers’ immediate intent.

Weakening Consumer Power: JOLTS, Wage Growth, and Purchase Intent

The August Job Openings and Labor Turnover Survey (JOLTS) showed 7.23 million openings, but the more telling metric is the slowdown in wage growth, which cooled to just +2.5% year-over-year. This is a significant drop from the +3.4% seen at the start of the year.

The direct link between the wage growth slowdown and consumer spend on digital ads cannot be overstated. When wages stagnate, consumer confidence falters. This translates to longer consideration phases for purchases, increased price sensitivity, and a “flight to value” where brands that communicate durability, ROI, and cost-effectiveness win out.

The Fed’s Response: A ~3.75-4.00% Rate Cut and Its Ripple Effects

In a proactive move driven by rising concerns about labor market softness, the Federal Reserve recently cut its policy rate by 25 basis points to a range of ~3.75–4.00%. This decision directly influences marketing budget adjustments for the Fed rate cut in 2025.

A rate cut makes borrowing cheaper, which can stimulate consumer urgency for financed, big-ticket purchases like homes and automobiles. However, it also serves as a clear signal of broader economic weakness, reinforcing the need for cautious and efficient marketing spend across the board. The demand signal from this drop in job openings is now being validated by federal policy.

The “Demand Signal Response” Playbook: A Step-by-Step Guide for Weaker Hiring Markets

In response to these clear hiring slowdown digital demand signals, marketers need a structured, agile framework. This “Demand Signal Response” playbook is a 90-day plan designed to stabilize performance, optimize spend, and build a foundation for efficient growth.

Phase 1 (Weeks 1-4): Build Your Data Fortress with First-Party Signals

Your first and most urgent task is to establish a single source of truth. Answering what first party signals replace delayed BLS data for campaign decisions is paramount. This means creating a weekly dashboard that tracks the real-time health of your marketing funnel.

This internal dashboard becomes your primary navigation tool, allowing you to react in days, not months. It provides the context needed to make smart decisions about performance marketing in slower labor markets.

| Metric Category | Key Performance Indicator (KPI) | What It Signals | Weekly Action |

| Website Engagement | On-site searches for “discount,” “pricing,” “free trial” | Rising price sensitivity; weakening purchase intent | Test value-based messaging on homepage |

| Lead Generation | CRM Lead Velocity Rate (LVR) | Slowdown in new business pipeline | Increase budget for high-intent, bottom-funnel keywords |

| Sales Funnel | MQL-to-SQL Conversion Rate | Lengthening sales cycles; stricter buyer criteria | Create and promote case studies proving ROI |

| E-commerce | Cart Abandonment Rate | Hesitation at the point of purchase | A/B test free shipping vs. 10% discount offers |

| Recruitment | Clicks on “Careers” Page | Declining organic interest in hiring | Reallocate job board spend to employer branding content |

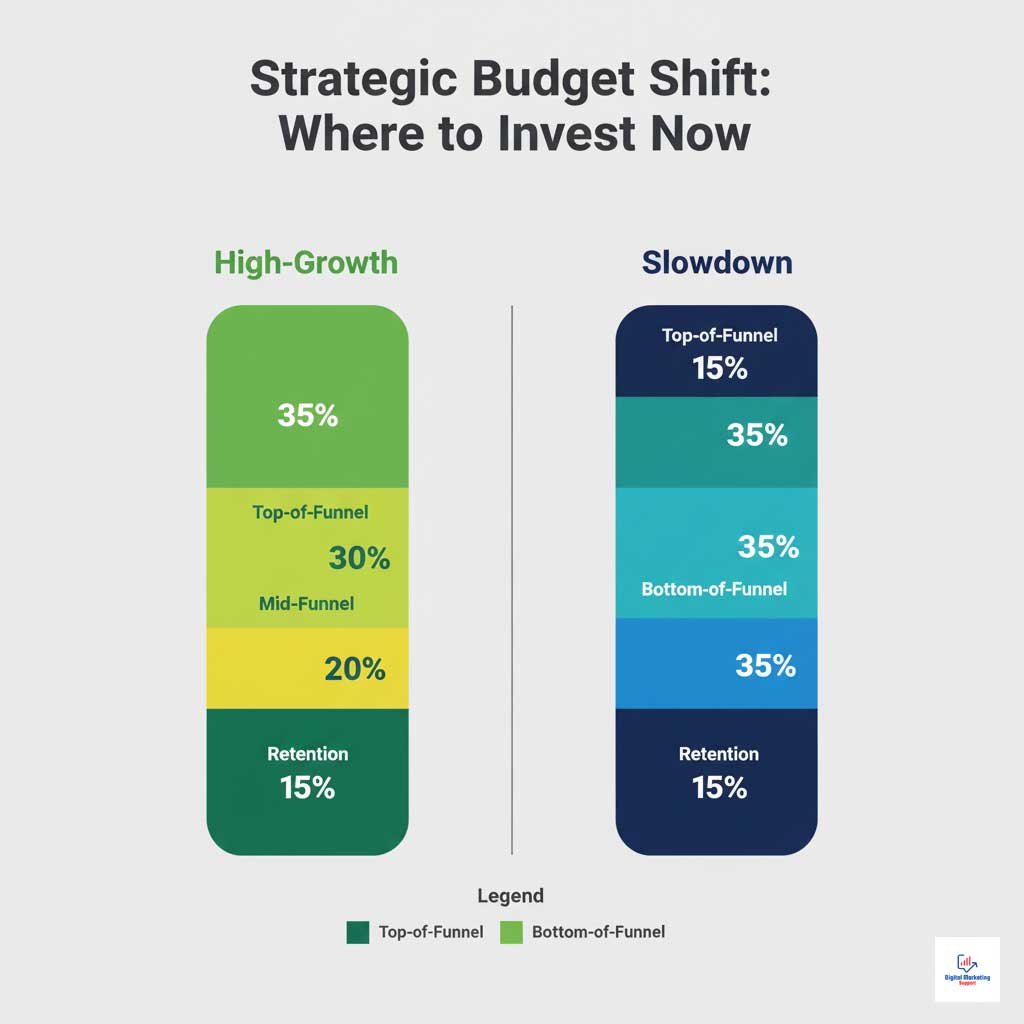

Phase 2 (Weeks 5-8): Optimize Budgets & Reallocate for High-Intent Wins

With a clear view of your internal data, the next step is to act on it. This phase focuses on how digital marketers should adjust ad budgets when job postings fall in October 2025. It’s not about cutting spend, but about reallocating it with surgical precision from low-performing areas to high-intent battlegrounds.

The core campaign pivot involves shifting funds from broad, top-of-funnel awareness campaigns—which are less effective when purchase intent is low—to mid-funnel nurturing and bottom-of-funnel conversion tactics.

| Channel / Tactic | Budget Allocation (High-Growth Market) | Budget Allocation (Job Market Slowdown) | Strategic Rationale |

| Top-of-Funnel (Awareness) | 35% | 15% | Cut spend on low-intent audiences; focus on efficiency. |

| Mid-Funnel (Consideration) | 30% | 35% | Nurture existing leads with ROI-focused content and case studies. |

| Bottom-of-Funnel (Conversion) | 20% | 35% | Double down on high-intent search, retargeting, and sales enablement. |

| Customer Retention & Loyalty | 15% | 15% | Maintain spend; it’s cheaper to retain than acquire a new customer. |

Phase 3 (Weeks 9-12): Drive Efficiency with AI and Automation

In a market where every dollar is scrutinized, efficiency is your greatest competitive advantage. This is where you leverage the best AI tools for reducing creative cost per conversion during a demand slump. Automation isn’t a luxury; it’s a core driver of profitable performance.

Case Study: AI-Powered Creative Optimization

A B2B SaaS firm, facing a 20% drop in lead velocity, used a generative AI platform to address the challenge. Instead of manually testing a few ad headlines, they generated over 50 value-based variants in one week. By deploying these at scale, they quickly identified a headline focused on “reducing operational costs by 15%” that lifted their MQL rate by 18%—all without increasing their ad spend.

This is a prime example of using technology to do more with less. Smart bidding strategies that ingest first-party signals from your dashboard can also automate paid media bidding during macro uncertainty, pulling back spend when your lead velocity slows and pushing it forward when high-intent search queries spike.

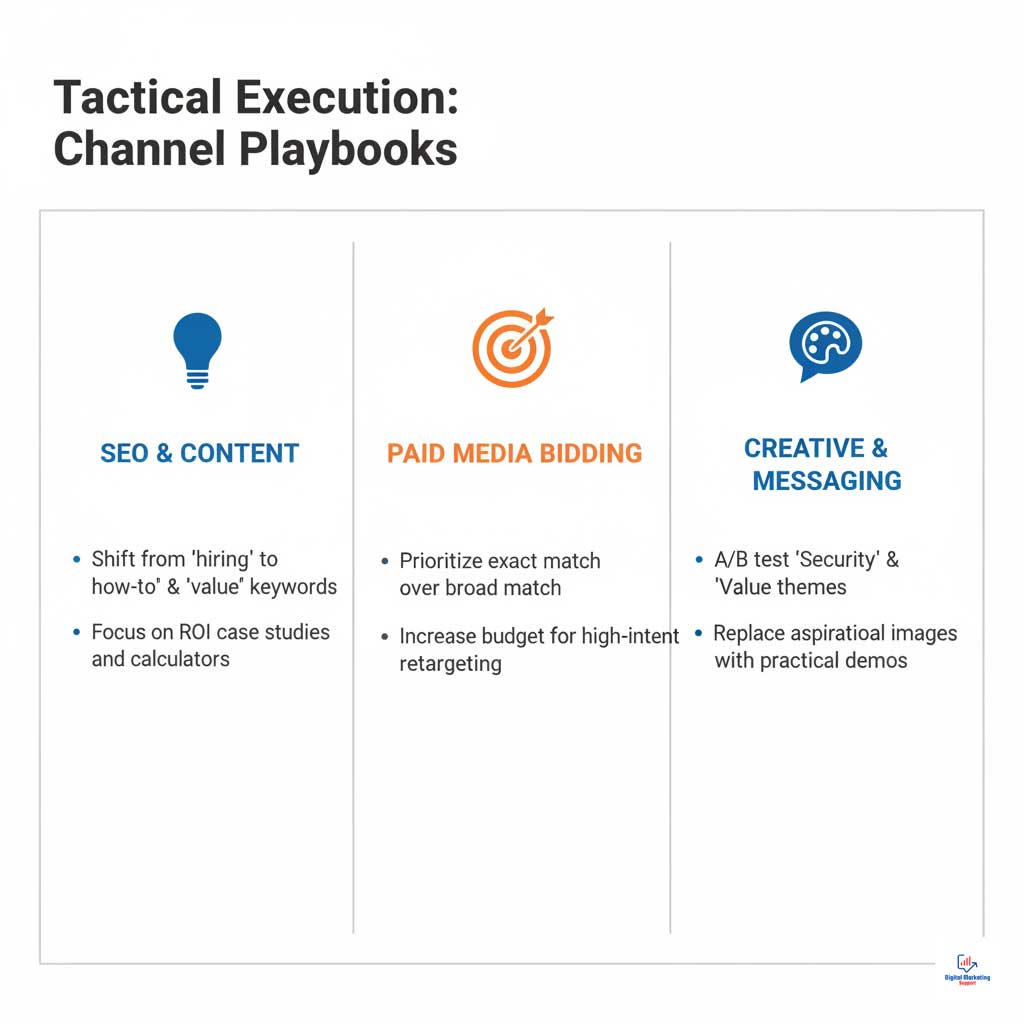

Deep Dive: Channel-Specific Tactics for Performance Marketing in Slower Labor Markets

A high-level strategy is only effective if executed with tactical excellence. Here’s how the principles of the digital marketing strategy job market slowdown apply to key channels.

SEO & Content: Pivot from Hiring to Helping

When the market is weak, search intent shifts from transactional to informational. Your content strategy must follow suit.

- Keyword Strategy: Deprioritize “hiring” and “jobs” content. Instead, focus on creating content that answers your customers’ most pressing questions about value, efficiency, and cost savings. Target keywords like “how to maximize your software budget” or “cost-effective alternatives to [competitor].”

- Content Themes: Develop content pillars around empathy, security, and ROI. Create detailed case studies, ROI calculators, and ultimate guides that prove the tangible value of your solution in a tough economic climate.

Paid Media Bidding: Surgical Strikes, Not Carpet Bombing

In an environment of macro uncertainty, your paid media approach must be disciplined. Wasted spend is no longer an option.

- Audience Targeting: Tighten your audience definitions. Pause broad match keywords in favor of exact and phrase match. Aggressively build and leverage retargeting lists, as converting a warm lead is far more cost-effective than acquiring a cold one.

- Bidding Strategy: Shift from “Target CPA” to “Target ROAS” bidding where possible. This forces the algorithm to optimize for revenue, not just lead volume, ensuring your ad spend is directly tied to business results.

Creative & Messaging: Resonate with the Cautious Consumer

Your ad copy and imagery must reflect the current customer mindset. Aspirational messaging often fails when budgets are tight; practical, benefit-driven communication wins.

- A/B Test Value Propositions: Rigorously test creative that emphasizes themes of security (“The most reliable platform for…”), value (“Get 30% more efficiency for the same cost”), and longevity (“Built to last through any market”).

- Visuals: Replace glossy, aspirational stock photos with practical visuals like product demos, customer testimonials, or simple charts that clearly illustrate ROI. Authenticity and proof build trust when consumer confidence is low.

Summary & Key Takeaways: Navigating the New Marketing Landscape

The economic shifts signaled by October’s job market data are not a reason to panic and slash budgets. Instead, they are a clear mandate to get smarter, more data-driven, and ruthlessly efficient. The impact of the job postings decline on marketing budgets is a call for strategic reallocation, not retreat. By embracing a new playbook, marketers can turn uncertainty into a competitive advantage.

- Trust Your Data First: In the absence of reliable government reports, your first-party signals are your most valuable strategic asset. Build a dashboard and let it guide your every decision.

- Shift from Volume to Value: Aggressively reallocate your budget from broad, top-of-funnel activities to high-intent, bottom-of-funnel channels that deliver measurable ROI.

- Embrace Radical Efficiency: Leverage AI and automation to reduce creative costs, optimize bidding in real-time, and get more performance from every dollar you spend.

- Message with Empathy and Proof: Your creative must resonate with the cautious consumer mindset. Focus on providing tangible value, proving your ROI, and building trust for the long term.

Frequently Asked Questions (FAQ)

How does a drop in job postings affect search intent for career queries?

A decline in job postings typically leads to a decrease in high-intent, transactional searches like “software engineer jobs” and an increase in informational searches like “career advice” or “how to upskill.” This shift means content marketing and SEO focused on thought leadership become more valuable.

Should marketers cut paid social spend when wage growth slows?

Not necessarily, but you should pivot. Instead of broad awareness campaigns, focus paid social efforts on high-intent retargeting and value-based messaging to existing followers. It’s more cost-effective to retain and upsell current customers than to acquire new ones in a downturn.

How fast should agencies pause vs. optimize client campaigns during an economic slowdown?

Optimization should always come before pausing. Immediately analyze performance to cut wasted spend and reallocate budget to proven, high-ROI channels. Pausing campaigns entirely risks losing market share to competitors who maintain their presence.

Do Fed rate cuts increase or decrease consumer urgency on big-ticket purchases?

Fed rate cuts generally increase urgency for financed purchases like cars and homes by making loans more affordable. Marketers in these sectors should ramp up advertising that highlights lower monthly payments and favorable financing terms.

What first-party metrics best substitute for delayed BLS reports?

Weekly tracking of website lead form submissions, sales-qualified lead (SQL) velocity in your CRM, and on-site search queries for price-sensitive keywords are excellent real-time substitutes for macroeconomic labor data.

Can programmatic bidding rules really incorporate macro signals like job postings?

Yes, sophisticated demand-side platforms (DSPs) and bidding tools with API access can be configured to adjust bid strategies based on external data feeds, including economic indices. This is an advanced tactic that requires technical expertise but can provide a significant competitive edge.

What messaging themes perform best when hiring and wage growth weaken?

Messaging themes centered on security, cost-effectiveness, proven ROI, and long-term value consistently outperform aspirational or luxury-focused themes. Empathy and acknowledging the economic climate can also build significant trust.

How can I convince leadership not to cut my marketing budget right now?

Present a data-driven case built on your first-party metrics. Show them the “Demand Signal Response” playbook and explain that this is an opportunity to gain market share by reallocating spend intelligently, not by making blanket cuts that will cede ground to competitors. Frame it as an investment in efficiency and future growth.